This week, domestic magnesium prices remained stable. As of this Friday, the mainstream prices of 90# magnesium ingots in the Fugu region were around 16,000 yuan/mt. Downstream price suppression inquiries were common, and magnesium producers faced severe losses, putting overall pressure on the magnesium market.

Traditionally, November-December has been the peak period for downstream market procurement. However, this year’s magnesium market performance during these months was disappointing. According to market quotations, domestic prices dropped from 17,900 yuan/mt at the beginning of October to the current 16,000 yuan/mt. Regarding the prolonged decline in magnesium prices this year, a representative from a major magnesium producer stated that the continuous price drop was related to oversupply on the supply side and changes in downstream procurement strategies.

On one hand, driven by the significant price increase last year, domestic magnesium ingot enterprises enjoyed high profits, maintaining strong operating rates. According to SMM statistics, cumulative domestic magnesium ingot production from January to November reached 870,000 mt, up 11.5% YoY, with a significant increase in supply compared to the same period last year. On the other hand, the sharp price hikes over the past two years attracted considerable market attention, fostering a speculative atmosphere. Downstream procurement costs surged. For example, in overseas markets, large fixed procurement orders have now generally shifted to smaller, fragmented orders. Combined with the impact of this year’s substantial supply growth, downstream buyers have widely suppressed prices in counteroffers, leading to a continuous decline in transaction prices.

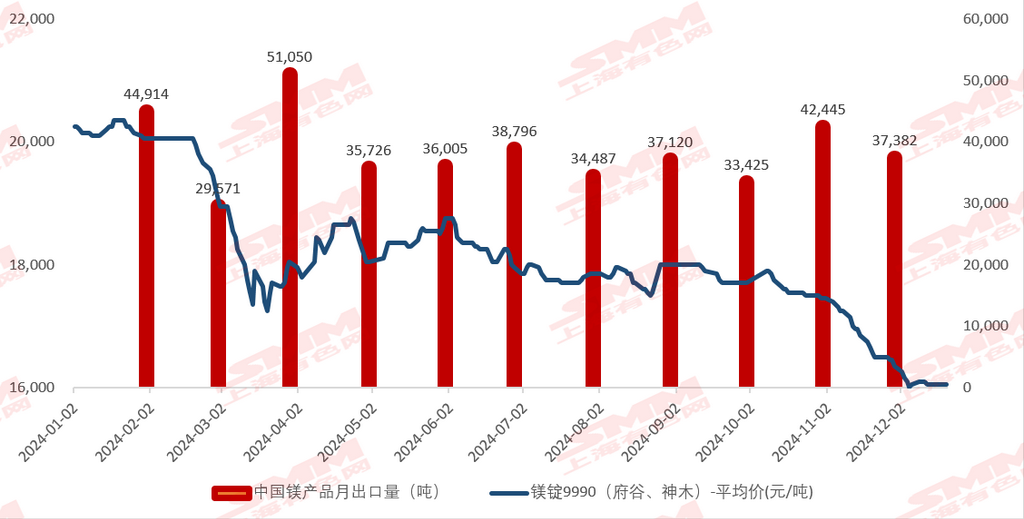

In addition to the above factors, SMM analysis suggests that weaker demand compared to supply is another key reason for the sustained decline in magnesium prices. According to customs data, from January to November 2024, China’s total magnesium product exports reached 421,000 mt, up 13.2% YoY, while magnesium ingot exports totaled 242,000 mt, up 23.2% YoY. However, the export growth was far below the supply increase. Meanwhile, the domestic macroeconomic environment remained weak, and consumption downgrades in downstream markets further reduced overall demand for magnesium ingots, keeping the magnesium market in an oversupply state throughout the year. With December already halfway through, the weak trend in magnesium ingot prices has yet to change. However, considering the upcoming year-end, it is expected that market transactions may recover slightly. SMM will continue to monitor subsequent market transaction developments.