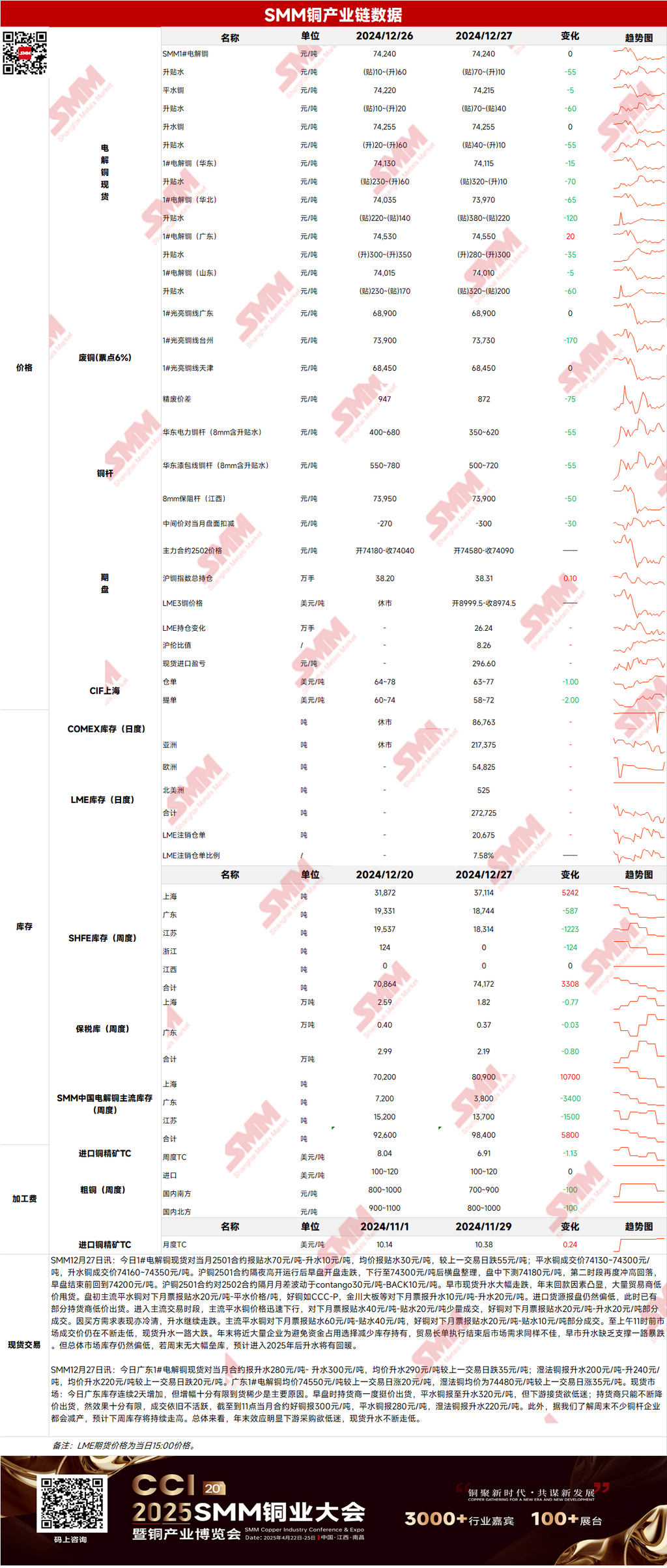

Futures Market: Last Friday night, LME copper opened at $8,961/mt, maintained wide fluctuations throughout the session, and saw its center rise during the fluctuations. It bottomed at $8,951/mt at the beginning of the session, peaked at $8,997/mt near the end, and finally closed at $8,981.5/mt, up 0.16%. Trading volume reached 9,000 lots, and open interest stood at 262,000 lots. Last Friday night, the most-traded SHFE copper 2502 contract opened lower at 73,930 yuan/mt, fluctuated upward at the beginning of the session, peaked at 74,180 yuan/mt during the session, then saw its center decline and maintained slight fluctuations near the end, finally closing at 74,070 yuan/mt, down 0.38%. Trading volume reached 15,000 lots, and open interest stood at 148,000 lots.

【SMM Copper Morning Brief】News: (1) ECB Governing Council member Holzmann stated that the ECB might consider waiting longer before the next interest rate cut.

(2) PBOC Governor Gongsheng Pan emphasized increasing the intensity and precision of monetary policy adjustments. He noted that the average reserve requirement ratio for the banking sector is approximately 6.6%, leaving some room compared to central banks in major global economies.

Spot Market: (1) Shanghai: On December 27, #1 copper cathode spot prices against the front-month 2501 contract were quoted at a discount of 70 yuan/mt to a premium of 10 yuan/mt, with an average at a discount of 30 yuan/mt, down 55 yuan/mt from the previous trading day. As the year-end approaches, many companies reduced inventory holdings to avoid capital occupation, and market demand weakened after the execution of long-term contracts. Spot premiums lacked support and plummeted during the early session. However, overall market inventories remained low. If there was no significant inventory buildup over the weekend, spot premiums are expected to recover after entering 2025.

(2) Guangdong: On December 27, Guangdong #1 copper cathode spot prices against the front-month contract were quoted at premiums of 280-300 yuan/mt, with an average premium of 290 yuan/mt, down 35 yuan/mt from the previous trading day. Overall, year-end effects were evident, with downstream purchasing interest remaining sluggish, leading to a continuous decline in spot premiums.

(3) Imported Copper: On December 27, warehouse warrant prices ranged from $63 to $77/mt, QP January, with an average down $1/mt from the previous trading day. B/L prices ranged from $58 to $72/mt, QP January, with an average down $2/mt. EQ copper (CIF B/L) was quoted at $13-27/mt, QP January, with an average down $1/mt, referencing cargoes arriving in late December and early January. On December 27, the SHFE/LME price ratio against the SHFE copper 2501 contract was around +30 yuan/mt. LME copper 3M-Jan contango stood at C$75.68/mt, while the 2501-2502 month-date contango was around C$43/mt. The SHFE/LME price ratio weakened compared to the previous trading day, and the import profit margin for the front-month contract significantly narrowed. Due to limited marketable cargoes, sporadic offers were relatively high, coupled with low market activity at the end of last week, resulting in scarce transactions in the US dollar copper market.

(4) Secondary Copper: On December 27, secondary copper raw material prices remained unchanged MoM. Guangdong bare bright copper prices were 68,800-69,000 yuan/mt, unchanged from the previous trading day. The price difference between primary metal and scrap was 872 yuan/mt, down 75 yuan/mt MoM. The price difference for rods was 785 yuan/mt. According to the SMM survey, Ningbo import traders indicated that as the year-end approaches, orders were mainly for pre-holiday stockpiling. Overseas quotes were relatively conservative, and due to the Christmas holiday overseas last week, there were few sell offers, resulting in average transactions.

(5) Inventory: On December 27, LME copper cathode inventories remained unchanged at 272,725 mt. On December 27, SHFE warehouse warrant inventories decreased by 50 mt to 13,011 mt.

Prices: Macro side, the upcoming Trump administration's policies remain uncertain. The US dollar index fluctuated and ultimately closed lower. However, domestic year-end consumption was weak, and the domestic and overseas markets showed mixed performance. Domestically, PBOC Governor Gongsheng Pan emphasized increasing the intensity and precision of monetary policy adjustments. Fundamentals side, as the year-end approaches, most companies controlled capital, and overall market purchasing interest was sluggish. In summary, with weak domestic consumption at year-end, copper prices are expected to fluctuate downward today.

》Click to View the SMM Metal Database

【The above information is based on market collection and comprehensive evaluation by the SMM research team. The information provided herein is for reference only and does not constitute direct investment research advice. Clients should make prudent decisions and not replace independent judgment with this information. Any decisions made by clients are unrelated to SMM.】