SMM, January 3:

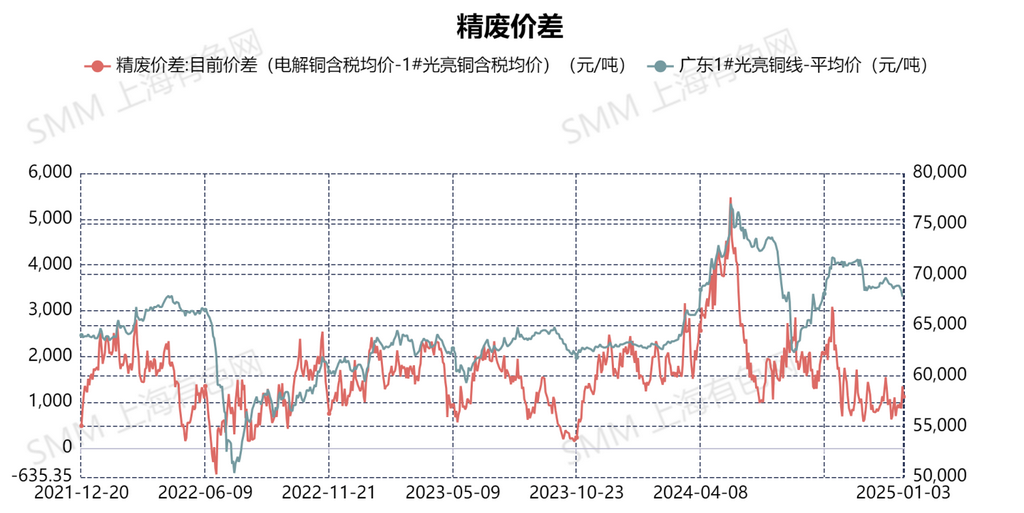

This week, copper prices dropped significantly by 1,300 yuan/mt. As of January 2, the average price of bare bright copper was 68,000 yuan/mt, down by 1,000 yuan/mt. After the New Year’s Day holiday, the impact of the "reverse invoicing" policy gradually became apparent. Over the past two days, price discrepancies have emerged in the secondary copper raw material market. Small and medium-sized recycling stations and yards across regions were cautious in their procurement quotes due to concerns about potential price declines caused by the policy. For instance, on January 2, the price of bare bright copper was 66,800 yuan/mt, while the procurement quotes from secondary copper rod plants were 67,600-67,800 yuan/mt. According to the SMM survey, secondary copper rod plants have not yet received any official notice or government directive mandating the implementation of "reverse invoicing." Most secondary copper rod plants are still procuring raw materials under the old model. This week, the inventory of secondary copper raw materials at sampled secondary copper rod enterprises was 4,950 mt, down by 1,550 mt from last week’s 6,500 mt. This decline was mainly because enterprises had stockpiled a significant amount of secondary copper raw materials before December 31, and their external procurement volume has noticeably decreased since January 1. Currently, the raw material inventory of enterprises can sustain operations for 2-3 days, maintaining a normal inventory level.

This week, the CIF quotation for #1 copper scrap was the COMEX 3M copper contract price minus 27-28¢/lb, while the CIF quotation for #2 copper scrap was the COMEX 3M copper contract price minus 33-34¢/lb. The CIF quotation for US brass scrap had an LME coefficient of 67-67.5%, with a fixed price of $5,950-6,000/mt (limited transactions). The CIF quotation for non-US Cu98.5% wire nodules had an LME coefficient of 96.25-96.5%, and the CIF quotation for non-US bare bright copper had an LME coefficient of 98.5-99% LME.

As copper prices continue to decline, suppliers’ willingness to sell has weakened. Some secondary copper rod enterprises indicated that if raw material procurement remains insufficient, they might consider shutting down furnaces early for maintenance, with the Chinese New Year break potentially starting one week earlier than usual.