SMM, January 7:

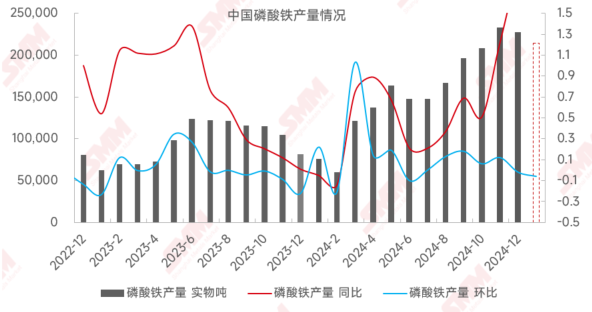

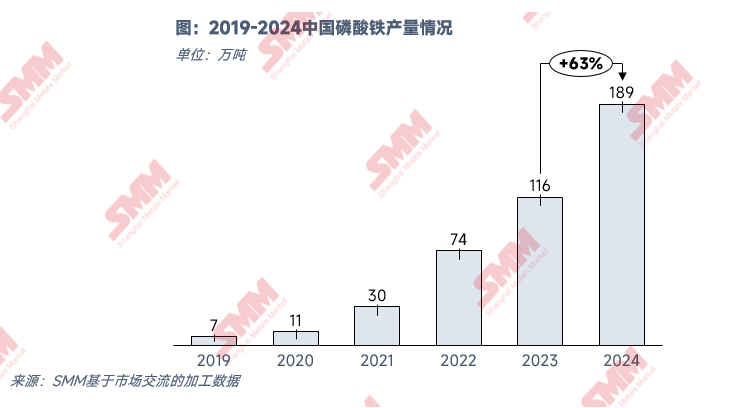

According to the SMM survey, China's total iron phosphate production in 2024 reached 1.886 million mt, up 63% YoY. Among them, the production of iron phosphate by non-integrated enterprises was 934,000 mt, accounting for 49.5% of the total production.

I. Overview of Market Prices and Trends in 2024

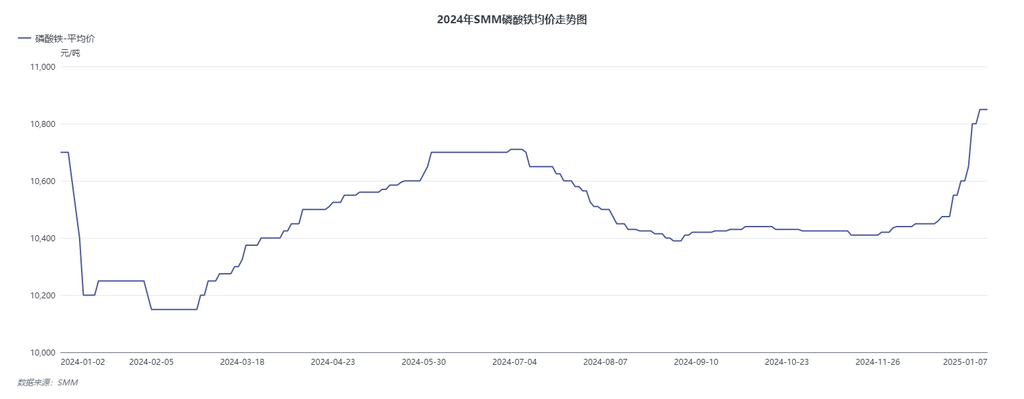

Market Slump at the Beginning of the Year, Reduced Supply : At the beginning of 2024, affected by the Chinese New Year holiday, the operating rate of iron phosphate enterprises declined, leading to a decrease in production. Market demand did not show significant improvement, resulting in insufficient production momentum in February. Meanwhile, downstream LFP enterprises continued to push for cost reductions, putting significant price pressure on iron phosphate enterprises.

Demand Recovery Mid-Year, Increased Supply : In Q2, with substantial demand growth from downstream LFP cathode and battery cell manufacturers, the price war in the NEV sector significantly boosted vehicle sales data, gradually reviving demand in the iron phosphate market. Starting in March, iron phosphate enterprises received a notable increase in orders, leading to higher operating rates and a significant rise in market supply.

Cost Increase and Price Rise at Year-End : By year-end, due to rising raw material prices and changes in the supply-demand relationship, the cost of iron phosphate increased. Coupled with robust year-end demand from downstream sectors aiming to boost sales, this gave long-struggling iron phosphate enterprises the confidence to stand firm on quotes. As a result, iron phosphate prices showed an upward trend in late December, with a relatively optimistic outlook for demand in 2025.

II. Analysis of Industry Pain Points in 2024—Severe Cut-Throat Competition, Difficulties in Increasing Revenue Despite Higher Production

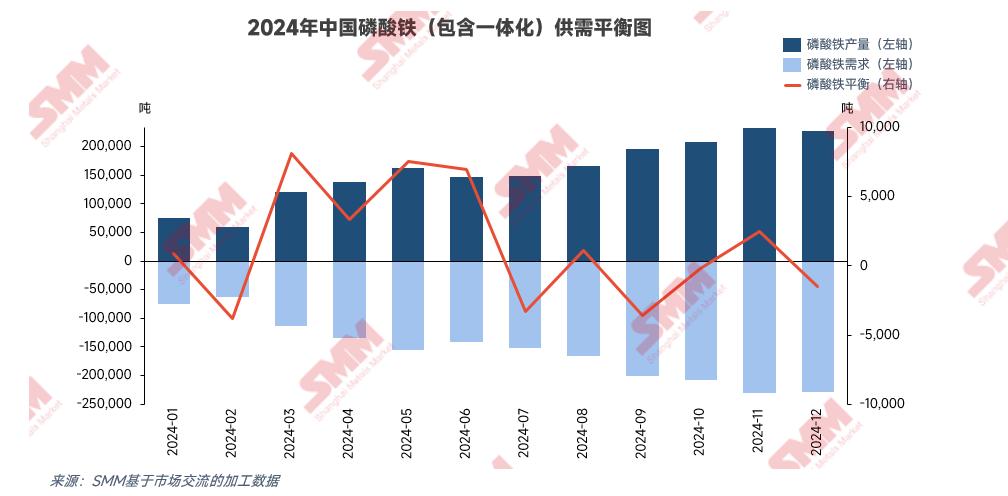

Severe Losses : Due to raw material price fluctuations, supply-demand imbalances, and low-price bidding, iron phosphate enterprises have long faced the challenge of losses. Although companies strive to negotiate better terms during order discussions, the results are minimal, severely squeezing profit margins.

Intense Price Competition : Downstream LFP enterprises' continuous cost-cutting efforts have intensified price competition among iron phosphate enterprises. To secure market share, some companies have had to adopt low-price strategies, further exacerbating profitability challenges in the industry.

Significant Supply-Demand Fluctuations : Influenced by policy adjustments and market demand changes, the supply-demand relationship in the iron phosphate market has fluctuated significantly. This instability poses substantial challenges to production planning and inventory management, increasing market risks.

In Q4, the iron phosphate market experienced a "once-in-a-century" year-end peak season. High-quality iron phosphate remains irreplaceable in LFP production, with tight supply and relatively high prices for this segment.

III. 2025 Iron Phosphate Market Outlook—Vigorous Development, Forging a Glorious New Chapter

In 2025, new iron phosphate capacity is expected to be released, primarily from well-established enterprises within the industry. After years of development, the industry structure has become relatively stable, leaving little room for new entrants without significant resource or product advantages to stand out in the highly competitive market.

From the market changes throughout 2024, it is evident that resource advantages play a crucial role in iron phosphate production. Phosphorus resources, represented by industrial monoammonium phosphate and phosphoric acid, and iron resources, represented by ferrous sulphate, are essential raw materials in iron phosphate production. In 2025, iron phosphate enterprises with phosphorus resource advantages are expected to pose challenges to those without such advantages. Iron phosphate enterprises need to strengthen collaboration across the industry chain, not only with upstream resource suppliers but also with downstream cathode, battery, and OEM manufacturers. Since iron phosphate is critical to the performance and quality of LFP, the validation period for iron phosphate used in power applications typically exceeds six months. Effectively binding downstream end-user customers will enable iron phosphate enterprises to gain a competitive edge in the fiercely competitive market, achieving resource sharing and complementary advantages. Additionally, expanding downstream customer bases to diversify risks, reducing reliance on single customers, and monitoring downstream customers' cash flow and payment recovery can help mitigate operational risks.

At the same time, enhancing technological innovation and cost control is essential. By innovating technology to reduce production costs and improve product quality and performance, enterprises can fundamentally strengthen their market competitiveness. Furthermore, optimizing production processes to minimize unnecessary waste can enhance profitability.

Reflecting on the iron phosphate market in 2024, it underwent a challenging development process, showcasing a complex and volatile market landscape. Facing issues such as losses, price competition, and supply-demand fluctuations, enterprises are actively seeking solutions and exploring future trends in 2025 to formulate reasonable market strategies, address potential risks, and seize development opportunities. Only by forging ahead and striving can iron phosphate enterprises secure a foothold in the fiercely competitive market.

As the industry becomes increasingly concentrated, the survival of the fittest in capacity has become more intense. Enterprises must compete in multiple areas, including capital, technology, management, and resources, enduring the test of time. Only by overcoming difficulties and navigating the intricate commercial landscape can they eventually emerge victorious, looking back to find that they have successfully crossed treacherous peaks and valleys, awaiting the bloom of success.

SMM New Energy Research Team

Cong Wang 021-51666838

Rui Ma 021-51595780

Ying Xu 021-51666707

Disheng Feng 021-51666714

Yujun Liu 021-20707895

Yanlin Lü 021-20707875