》View SMM Cobalt and Lithium Product Prices, Data, and Market Analysis

》Subscribe to View Historical Price Trends of SMM Cobalt and Lithium Spot Products

SMM January 10 News:

For the anode industry, the year 2024 was not an easy one. Issues such as overcapacity and declining product profits were not just alarmist warnings like the Sword of Damocles hanging overhead but rather heavy burdens pressing down on the industry. Fortunately, anode enterprises were not like Sisyphus in vain; while the burden was heavy, it was not an insurmountable barrier. On the contrary, under the backdrop of the continuous development and expansion of the new energy industry, the anode industry in 2024, to some extent, moved away from the previous blind and aggressive sentiment, adopting more developmental thinking and approaches to pursue a healthier market environment and growth trajectory. While the production and sales scale of anode materials further increased, the industry also underwent significant transformations.

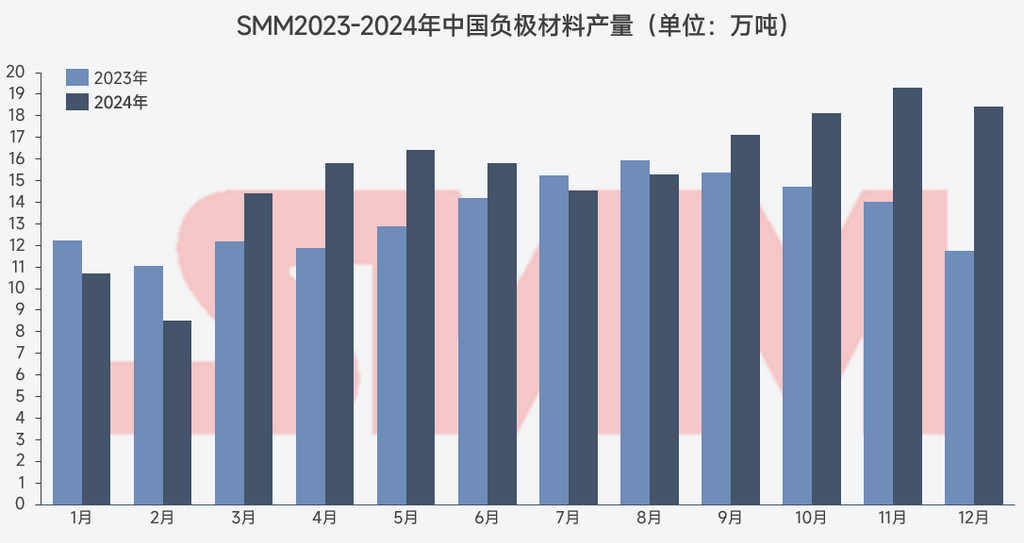

According to SMM statistics, in 2024, China's graphite anode material production reached 1.845 million mt, up 14% YoY compared to 2023.

Chart: SMM 2023-2024 China Anode Material Production (Unit: 10,000 mt)

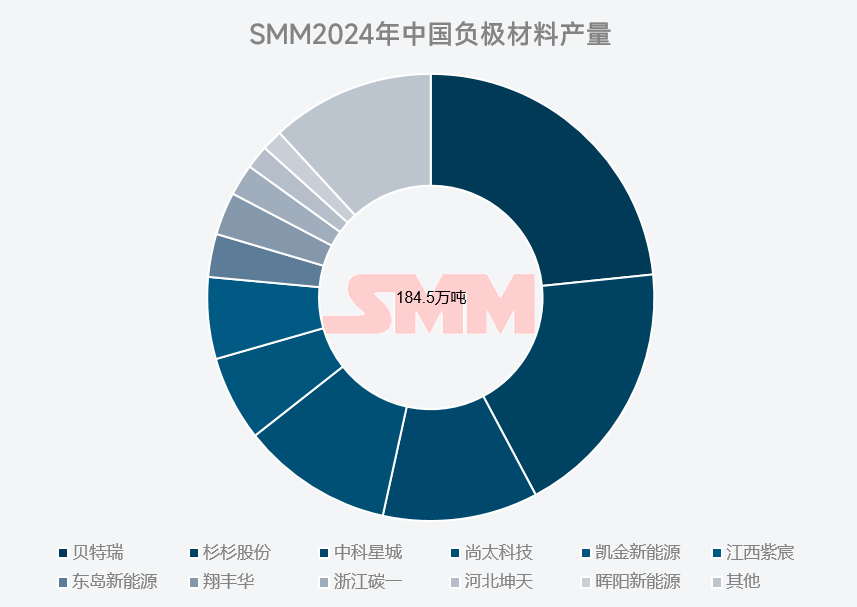

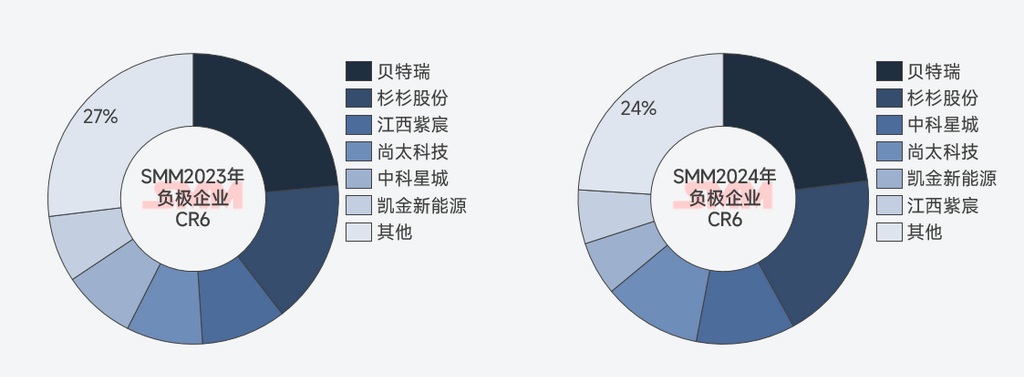

In 2024, BTR continued to maintain its leading position in the anode material industry, accounting for approximately 23% of the total. Notably, the "three major and four minor" industry structure underwent significant adjustments in 2024. Companies such as Hunan Zhongke Shinzoom Co., Ltd., Shangtai Technology, and Kaijin New Energy closely followed the growth in downstream demand, actively responding to new product iterations and applications, resulting in improved rankings compared to previous years. Meanwhile, companies like Jiangxi Zichen reasonably arranged material production and sales based on their circumstances, improved inventory and production cost management, and built high-quality downstream customer chains. Although their production and sales rankings declined, they still achieved improvements in their overall anode business.

Chart: SMM 2024 China Anode Material Production Chart

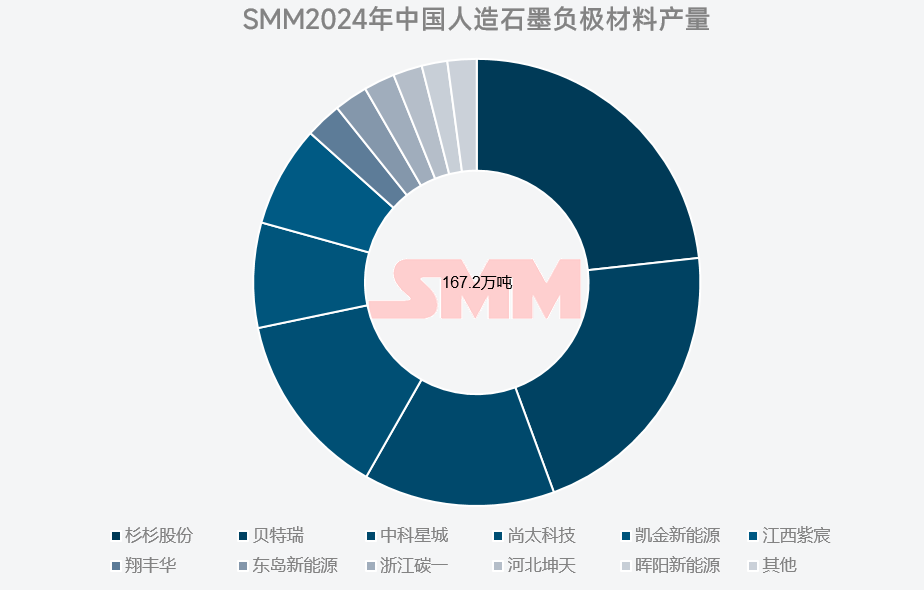

In 2024, with the application of advanced technologies such as anode-specific coke and continuous graphitisation, the production cost of artificial graphite was further controlled, leading to a price decline. At the same time, due to restrictions on natural graphite exports, some overseas customers gradually shifted their raw material usage to artificial graphite, further increasing its market share. According to SMM statistics, in 2024, China's artificial graphite anode production reached 1.672 million mt, up 15% YoY, accounting for 90.6% of the total graphite anode production. Shanshan Corporation also maintained its leading position in artificial graphite anode production in 2024, accounting for approximately 21% of the total.

Chart: SMM 2024 China Artificial Graphite Anode Production Chart

With the continuous progress and development of the new energy industry, in addition to the growth in scale, the iteration and upgrade of new products have further enhanced customer demand for anode material performance. For instance, in the power sector, as NEVs raise their standards for driving range and charging performance, power battery cells have higher requirements for anode capacity and fast charging C-rate. Top-tier enterprises launched high-capacity fast-charging anode products in 2024, significantly contributing to their scale growth. Meanwhile, new entrants like Sunrise New Energy seized the critical period of the 314Ah battery cell iteration in the ESS sector, actively responding to industry upgrades and customer demands, achieving significant improvements in their production, sales, and industry share. In the consumer sector, with the launch of multiple new models, silicon-based anode materials also saw broader applications.

Chart: SMM 2023-2024 Anode Industry CR6

In 2024, the concentration of the anode industry continued to rise, with CR6 reaching 76%. Against the backdrop of limited cost reduction space for anode materials, downstream customers shifted their focus to "quality" and "supply." Leading anode enterprises, benefiting from their deeper technical expertise, superior material specifications, and larger-scale production and supply, not only ensured "quality and quantity" but also curbed malicious price competition in the industry—blindly lowering prices at the expense of profits only harms a company's financial health, hindering long-term operations and making it difficult to respond promptly to short-term market fluctuations. In fact, in 2024, some ultra-low procurement prices from earlier periods faced widespread resistance within the anode industry. Although an industry-wide price rebound has yet to occur, this at least demonstrates the anode industry's pursuit of a healthy market environment and affirmation of sound operational practices. Anode prices in 2024 have already approached "bottom levels," and a "rebound" is not an unattainable future.

From the perspective of prices and profits, 2024 was indeed not particularly remarkable. Low prices continued to pressure the anode industry and even tightened conditions for upstream related industries. However, beneath the "ice surface" lie changes that are difficult to discern in the short term but will have far-reaching impacts later. Adjustments in corporate strategies and shifts in industry sentiment will provide opportunities for the anode material market to improve. As the saying goes, "A thousand sails pass by the side of a sunken ship; after the snow melts and ice thaws, the anode industry is poised to embrace the spring of 2025."

SMM New Energy Research Team

Cong Wang 021-51666838

Xiaodan Yu 021-20707870

Rui Ma 021-51595780

Ying Xu 021-51666707

Disheng Feng 021-51666714

Yujun Liu 021-20707895

Yanlin Lü 021-20707875

Ye Yuan 021-51595792

Chensi Lin 021-51666836

Zhicheng Zhou 021-51666711

Haohan Zhang 021-51666752

Zihan Wang 021-51666914

Xiaoxuan Ren 021-20707866

Yushuo Liang 021-20707892

Jie Wang 021-51595902

Yang Xu 021-51666760