[SMM HRC Daily Review] Futures Continue Weak Trend: How Much Further Downside Is There?

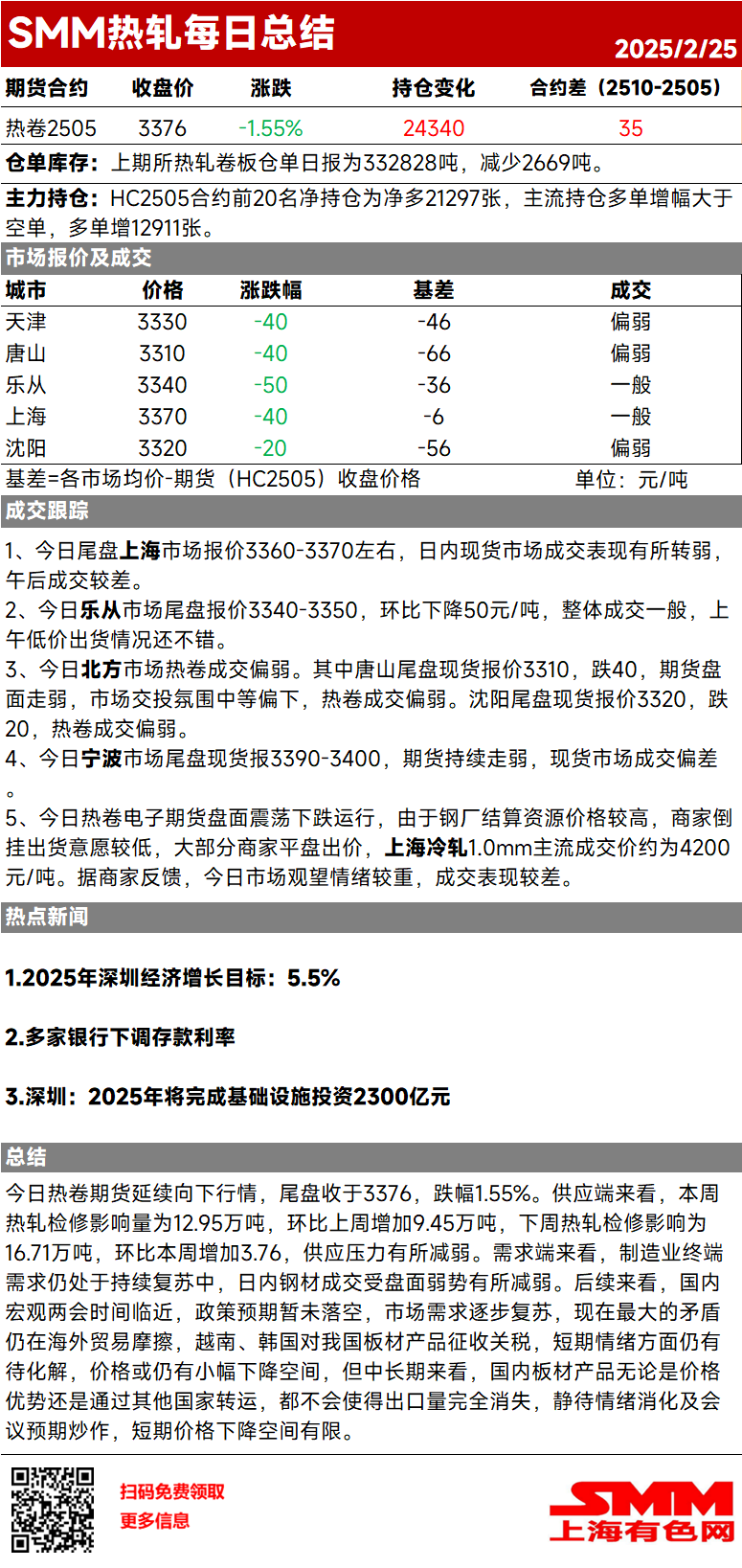

Today, HRC futures continued their downward trend, closing at 3,376, down 1.55%.

Supply side, this week's impact from HRC maintenance was 129,500 mt, up 94,500 mt WoW. Next week's impact from HRC maintenance is expected to reach 167,100 mt, up 3.76 WoW, easing supply pressure to some extent.

Demand side, end-use demand in the manufacturing sector remains in a continuous recovery phase, while daily steel transactions weakened due to the bearish futures market.

Looking ahead, with the domestic macro Two Sessions approaching, policy expectations have not yet been disappointed, and market demand is gradually recovering. The biggest imbalance currently lies in overseas trade frictions, as Vietnam and South Korea impose tariffs on China's sheet & plate products. In the short term, sentiment still needs to stabilize, and prices may see slight downward adjustments. However, in the medium and long-term, China's sheet & plate products, whether through price advantages or transshipment via other countries, are unlikely to see export volumes completely disappear. As sentiment stabilizes and policy expectations are priced in, the short-term downside for prices is limited.

HRC futures continued their downward trend today, closing at 3,376, down 1.55%.

Supply side, this week's impact from HRC maintenance reached 129,500 mt, up 94,500 mt WoW. Next week's impact from HRC maintenance is expected to reach 167,100 mt, up 3.76 WoW, slightly easing supply pressure.

Demand side, end-use demand in the manufacturing sector remains in a continuous recovery phase, while daily steel transactions weakened due to the bearish futures market.

Looking ahead, with the domestic macro Two Sessions approaching, policy expectations have not yet been disappointed, and market demand is gradually recovering. The biggest imbalance currently lies in overseas trade frictions, as Vietnam and South Korea impose tariffs on China's sheets & plates products. In the short term, sentiment remains unresolved, and prices may still have room for slight declines. However, in the medium and long-term, China's sheets & plates products, whether through price advantages or transshipment via other countries, will not see export volumes completely disappear. As sentiment stabilizes and policy expectations are speculated upon, the short-term price decline is expected to be limited.