[SMM HRC Daily Review] Market Sentiment Cools, Short-Term Coil Prices Fluctuate Downward

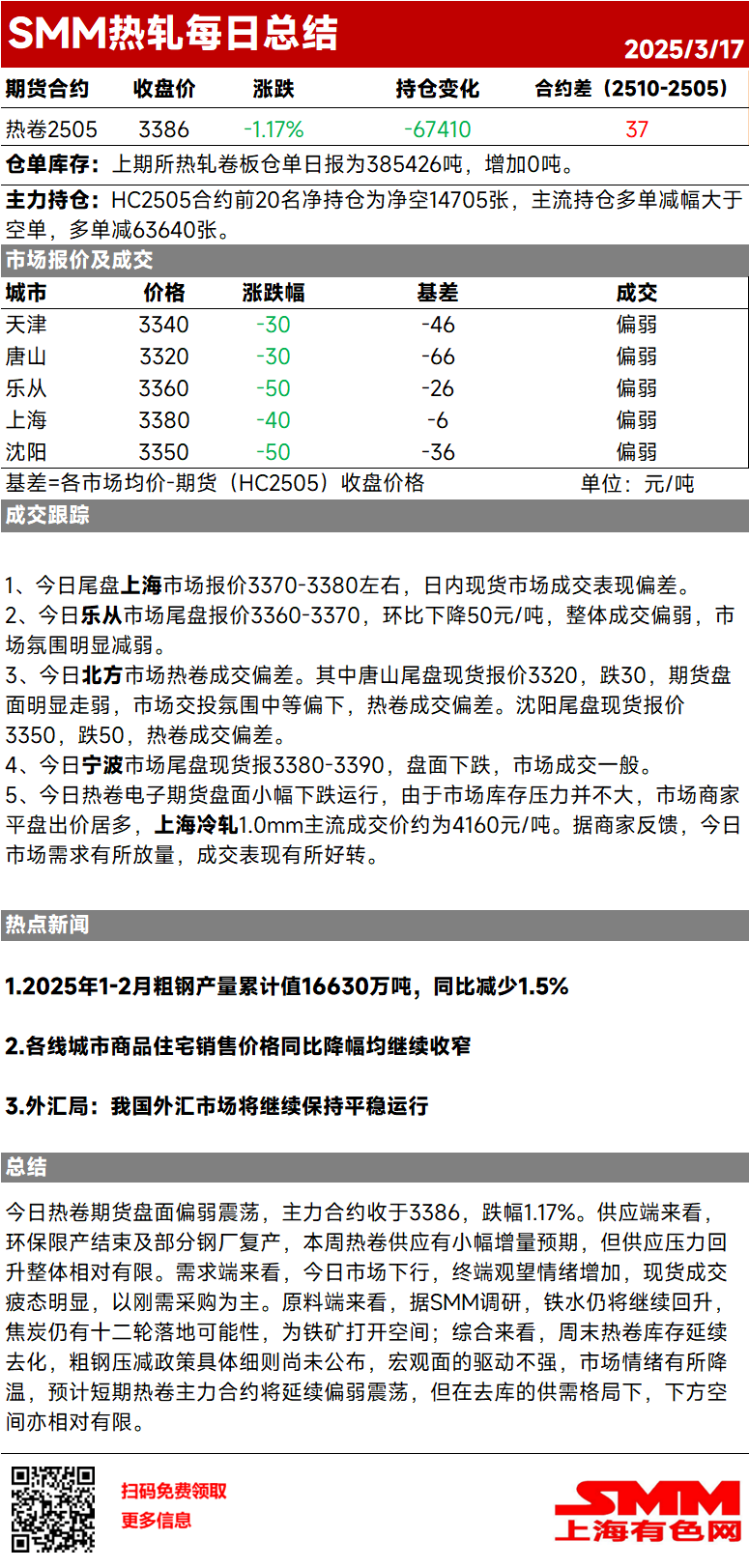

Today, HRC futures fluctuated downward, with the most-traded contract closing at 3,386, down 1.17%. Supply side, with the end of environmental protection-driven production restrictions and the resumption of production at some steel mills, HRC supply is expected to see a slight increase this week, but the overall supply pressure rebound remains relatively limited. Demand side, the market declined today, end-user sentiment turned more cautious, and spot transactions were evidently sluggish, primarily driven by just-in-time procurement. Raw material side, according to the SMM survey, pig iron output is expected to continue rebounding, and there is still a possibility of the twelfth round of coke price cuts, which could create room for iron ore. Overall, HRC inventory continued to decline over the weekend, while the detailed rules of the crude steel production reduction policy have yet to be announced. The macro front lacks strong drivers, and market sentiment has cooled. In the short term, the most-traded HRC contract is expected to continue fluctuating downward, but the downside remains relatively limited under the supply-demand pattern of destocking.

HRC futures fluctuated downward today, with the most-traded contract closing at 3,386, down 1.17%. Supply side, with the end of environmental protection-driven production restrictions and some steel mills resuming production, HRC supply is expected to see a slight increase this week, but the overall supply pressure rebound remains relatively limited. Demand side, the market declined today, end-user sentiment turned more cautious, and spot transactions were evidently sluggish, mainly driven by just-in-time procurement. Raw material side, according to the SMM survey, pig iron output is expected to continue rebounding, and there is still a possibility of the twelfth round of coke price adjustments, which could create room for iron ore. Overall, HRC inventory continued to decline over the weekend, while specific details of crude steel output reduction policies have yet to be announced. The macro front lacks strong drivers, and market sentiment has cooled. In the short term, the most-traded HRC contract is expected to continue fluctuating downward, but the downside remains relatively limited under the destocking supply-demand pattern.