This week, the destocking speed of construction steel inventory accelerated, with total rebar inventory down 5.79% WoW and total wire rod inventory down 14.42% WoW. Supply side, the profit divergence between blast furnace steel mills and EAF steel mills widened this week. Blast furnace steel mills remained profitable, and their production willingness was moderate. Some previously maintained steel mills resumed production as planned. EAF steel mills faced difficulties in collecting steel scrap and amplified losses, leading some electric furnace mills to shorten operating hours. However, as some EAF mills resumed production as planned this week, the overall supply increased slightly. Demand side, the rigid demand in the construction industry continued to recover, and the total construction inventory remained in the destocking phase, with no prominent fundamental imbalance.

This week, total rebar inventory stood at 6.8477 million mt, down 421,000 mt WoW, a decline of 5.79% (previous: -2.38%). Compared to the same period last year in the lunar calendar, it decreased by 2.0035 million mt, a YoY decline of 22.64% (previous: -23.24%).

Table 1: Overview of Rebar Inventory

Data Source: SMM

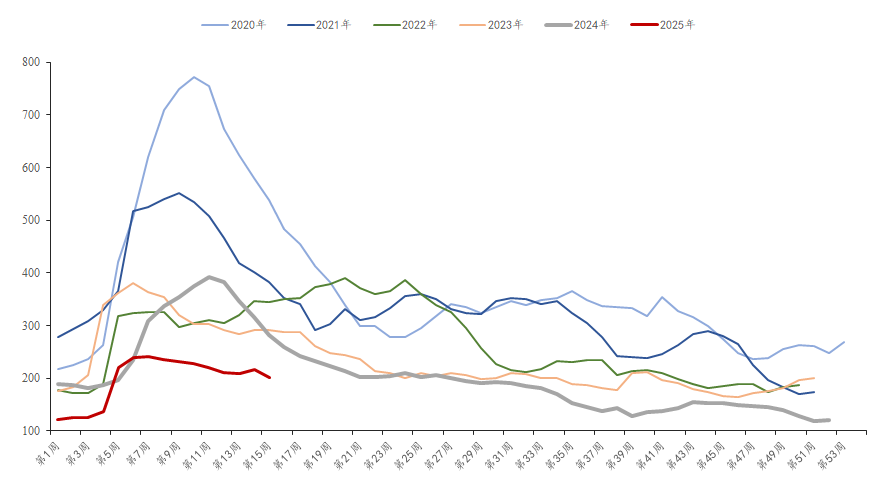

This week, in-plant rebar inventory was 2.0151 million mt, down 145,200 mt WoW, a decline of 6.72% (previous: 3.65%). Compared to the same period last year, it decreased by 408,300 mt, a YoY decline of 16.85% (previous: -16.74%). Due to the continuous downward fluctuation in prices, it has now dropped to a low level, and there is a restocking demand from end-users. Direct supply from steel mills has increased, and the decline in in-plant inventory has amplified compared to the previous period.

Chart 1: Trend of Rebar In-Plant Inventory, 2020-2025

Data Source: SMM

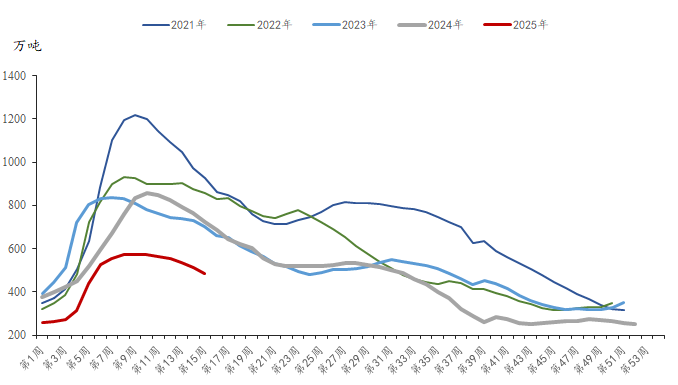

This week, social rebar inventory was 4.8326 million mt, down 275,900 mt WoW, a decline of 5.40% (previous: -4.73%). Compared to the same period last year, it decreased by 1.5952 million mt, a YoY decline of 24.82% (previous: -25.69%). This week, rigid demand continued to recover, and transactions of low-priced resources were moderate. However, short-term tariff disputes have left the macro market situation unclear, and speculative demand was average. Overall, social inventory continued to decline this week.

Chart 2: Trend of Rebar Social Inventory, 2021-2025

Data Source: SMM

Overall, the steel market currently sees both supply and demand increasing, with construction material inventory continuing to decline. The fundamental imbalance is not prominent. It is expected that the "Golden March and Silver April" will continue to exert residual effects, and the impact of tariff disputes will weaken, potentially driving a slight increase in steel demand. Steel inventory is expected to continue declining next week, with subsequent focus on changes in macro policies and end-use demand.