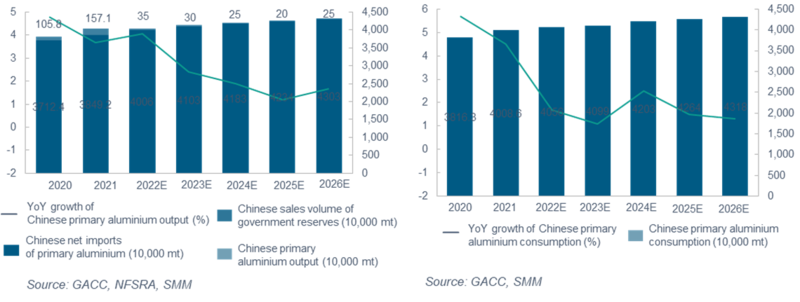

SHANGHAI, Jan 9 (SMM) - The year-on-year increase in domestic aluminium production in 2022 is mainly contributed by the production recovery in Yunnan and Inner Mongolia from power rationing. However, in the third quarter, the domestic power supply became tight again, resulting in the shutdown of aluminium smelters in Sichuan, as well as the energy consumption control towards smelters in Yunnan, which are required to reduce their operating rates until May 2023. However, since a large number of aluminium smelters reduced or suspended the production in 2021, the overall output in 2022 will still increase by 4.1% year-on-year. In terms of demand, the surprises are contributed by aluminium extrusion for photovoltaic, for lightweight new energy vehicles, and for export, which has offset the collapse of demand in the real estate industry chain.

SMM believes that domestic aluminium production in 2023 will continue to rise year-on-year with the support from the commissioning of new capacities in Guizhou and Inner Mongolia and the production resumption in Yunnan, Sichuan, Guangxi. As for demand, domestic aluminium extrusion exports are expected to fall from a high level, but aluminium extrusion for photovoltaic and new energy vehicles will continue to underpin aluminium demand. Yet, a key concern in the future will be the stability in the real estate market.

The year of 2022 features high capacity utilisation rates and efficient production for the aluminium industry. Though the production has been contained by the power rationing in Yunnan and Sichuan in the third quarter, the year-to-date output still managed a YoY growth of more than 4%. Should the capacity in Yunnan be resumed in 2023, the overall aluminium supply will increase further.

The focus on the demand side lies in when the demand will find the ground. The construction activities in the domestic real estate industry will be propelled by policy support in the short term. However, from a long-term perspective, the domestic real estate market may have already entered the downward cycle. Whether the market can stabilise will depend on when the financing environment of property developers will improve. Demand from the photovoltaic and new energy sectors will remain strong, but they account for only a small share of the total aluminium consumption. On the whole, the domestic demand may increase slightly in 2023.

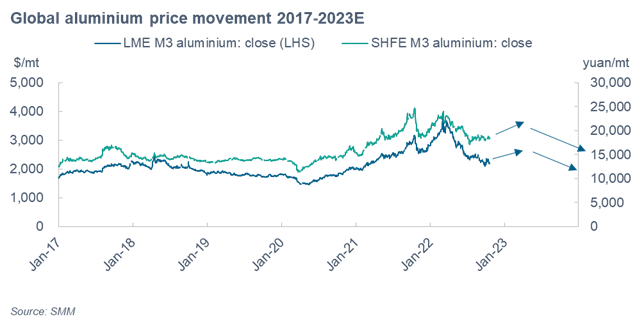

As such, SMM estimates that the domestic aluminium market will be in a mild surplus. The past experience showed that aluminium smelters would not take the initiative to reduce their production, unless they suffered losses of more than 2,000 yuan/mt for 2-3 months. From the perspective of costs, only when 25-50% of smelters suffer losses, namely when aluminium prices fall to around 16,000-17,000 yuan/mt, will the prices find cost support.

The output cuts by European aluminium smelters barely had any significant impact on aluminium prices and the market supply-demand structure, and the fundamental reason is that the magnitude of output cuts has been too small. As of the fourth quarter of 2022, some 1.54 million mt of aluminium capacity in Europe was scaled back, and most of the smelters reduced their capacity by just 30-60%. This was equivalent to a loss of 700,000-800,000 mt of aluminium output, accounting for only 1% of the world’s total. The overall demand in Europe collapsed due to tightening liquidity and severe debt problems. In terms of supply, since the overseas natural gas and electricity prices have somehow fallen back in the fourth quarter of 2022, European aluminium smelters are likely to resume their production in 2023. From the perspective of demand, due to the stubbornly high inflation and debt in Europe and the US, the demand in Europe is expected to continue to fall in 2023.

Taken altogether, the global aluminium market will enter a surplus in 2023, with eyes on potential sanctions on Rusal.