SHANGHAI, Jan 10 (SMM) - 2022 is another year that has witnesses the nickel price turmoil. In March 2022, nickel prices soared to a record high. In the second quarter, the prices were on a downward trend and returned to the fundamentals due to COVID-19 outbreak and the macro factors. In the middle and late third quarter, steel mills were expected to resume their production owing to the sharp drop in stainless steel supply earlier, pushing up the short-term stainless steel output and the nickel demand. In addition, the new energy industry mushroomed in the third quarter. The operating rates of battery companies grew amid the improvement of orders, the low inventory of precursor companies, the rapid expansion of the leading battery producers, etc. Nickel demand gained strong support from the new energy industry. As a result, the prices rallied from lows.

In terms of the fundamentals in 2022, the US Fed continued to raise the interest rates to temper inflation. The global economy showed signs of recession from time to time, and overseas consumption, especially in European countries, slumped, while nickel consumption performed relatively well. The two major downstream markets, the stainless steel and new energy industries both maintained positive growth, and the nickel demand in the latter burgeoned by more than 30% year-on-year. Nickel demand from the military alloy sector grew apace, while that from the electroplating sector performed poorly during the year.

In 2023, the market may witness a significant supply surplus of primary nickel, especially the NPI. Besides, the refined nickel supply will also be in surplus. Nonetheless, the same scenario is unlikely happen to nickel sulphate in 2023 because of its capacity mismatch. The Indonesian government’s potential export tax hike on nickel products may, on the other hand, affect the rhythm of NPI production and cause oversupply. The global economy will not be optimistic in 2023. Under the influence of factors on the fundamentals and macro front, nickel prices will fluctuate wildly with a high probability and will trend lower amid the expected supply surplus.

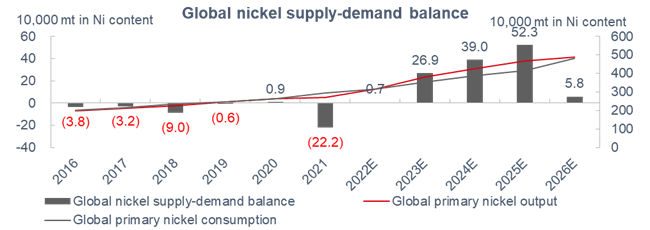

In 2022, the global primary nickel consumption is expected to be 3.14 million mt in Ni content, up 6.9% YoY. The supply will add 15.9% YoY to 3.148 million mt in Ni content. The global primary nickel surplus will reach 8,000 mt in Ni content. The market should see no supply surplus if the downstream restocking demand had been taken into account. In 2022, nickel supply has been relatively tight, which is mainly caused by the lower-than-expected growth of supply. The commissioning of Indonesia NPI slowed down, and some production lines were switched to produce high-grade nickel matte, reducing the expectations of NPI oversupply to some extent. Meanwhile, the nickel salt output, restricted by the mismatch between converted battery-grade nickel sulphate capacity and the raw material types, failed to surge, thus the market supply was in deficit for most of the year.

In 2023, the surplus is expected to expand further. In addition to the impact of the aforementioned delays in the commissioning of some capacity, the demand from the new energy industry will stimulate the production and ramp-up of the upstream producers. In 2023, the total supply will reach 3.808 million mt in Ni content while the demand will be 3.54 million mt in Ni content, resulting in a supply surplus of 269,000 mt in Ni content, which is mainly contributed by NPI supply since there will be multiple new NPI production lines put into production. SMM predicts that SMM #1 refined nickel prices will move between 143,000-178,000 yuan/mt, with an average of 160,500 yuan/mt.